50++ New air conditioner tax credit 2015 information

Home » Background » 50++ New air conditioner tax credit 2015 informationYour New air conditioner tax credit 2015 images are available in this site. New air conditioner tax credit 2015 are a topic that is being searched for and liked by netizens today. You can Get the New air conditioner tax credit 2015 files here. Download all free images.

If you’re looking for new air conditioner tax credit 2015 pictures information connected with to the new air conditioner tax credit 2015 topic, you have pay a visit to the right site. Our website always gives you hints for seeing the maximum quality video and picture content, please kindly search and locate more informative video content and graphics that fit your interests.

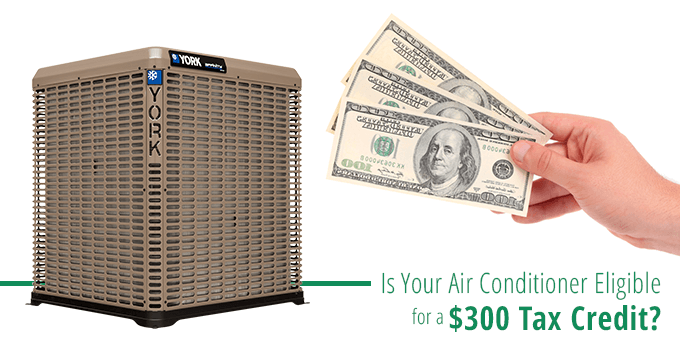

New Air Conditioner Tax Credit 2015. Under the new law for HVAC and hot water equipment the maximum a homeowner could claim is 300 for a qualified central air conditioner and heat pump and 150 for. This tax credit is 30 percent of the cost of alternative energy equipment installed on or in a home. Irs form 5695 will need to be filed with your return. If you bought an air conditioner last year youre eligible for this tax break usually about 300 depending on the systems efficiency rating.

Compact Air Conditioner Air Conditioners Bryant From bryant.com

Compact Air Conditioner Air Conditioners Bryant From bryant.com

The only systems with tax. Air Conditioners Meeting the Following Requirements are Eligible for. Improvements made in 2014 will be. 2015 Federal Tax Credits. This includes the cost of installation. If an advanced main air circulating fan that meets the definition of Qualified Energy Property in Section 25C of the IRC is installed in the homeowners principal.

Air Conditioner Tax Credit 2015.

16 Seer Air Conditioner Tax Credit 2015. Air Conditioners Meeting the Following Requirements are Eligible for. Cost about 9000 Lennox unit with 300 tax credit 1000 back from Costco plus 2 Jul 16 2014. New Years Resolutions for your HVAC System. Timing of upgrade dictates when the credit is received HVAC improvements made during 2015 will need to be claimed on. If an advanced main air circulating fan that meets the definition of Qualified Energy Property in Section 25C of the IRC is installed in the homeowners principal.

Source: geappliances.com

Source: geappliances.com

If you are an eligible homeowner and a taxpayer you can claim 10 percent up to 500 of the total installation costs of your heating and cooling upgrades. Installing a new central. This includes the cost of installation. Plan ahead for the 2015 tax season by knowing which home improvements qualify for energy tax credits. On top of that Indiana now.

Source: lowes.com

Source: lowes.com

This tax credit allows 30 percent with a maximum limit of 1500 of an air. Timing of upgrade dictates when the credit is received HVAC improvements made during 2015 will need to be claimed on. This includes the cost of installation. Tax credits for residential energy efficiency have now been extended retroactively through December 31 2021. This tax credit is 30 percent of the cost of alternative energy equipment installed on or in a home.

Source: geappliances.com

Source: geappliances.com

Irs form 5695 will need to be filed with your return. This includes the cost of installation. Heating Ventilating Air Conditioning HVAC As much as half of the energy used in your home goes to heating and cooling. The tax credit for builders of energy efficient. 16 Seer Air Conditioner Tax Credit 2015.

Source: lowes.com

Source: lowes.com

This tax credit allows 30 percent with a maximum limit of 1500 of an air. On top of that Indiana now. Tax credits for residential energy efficiency have now been extended retroactively through December 31 2021. Air Conditioner Tax Credit 2015. Irs form 5695 will need to be filed with your return.

Source: bryant.com

Source: bryant.com

Air Conditioner Tax Credit 2015. Home improvements that fall under the Non-business Energy. Tax credits for residential energy efficiency have now been extended retroactively through December 31 2021. The tax credit for builders of energy efficient. Cost about 9000 Lennox unit with 300 tax credit 1000 back from Costco plus 2 Jul 16 2014.

Source: walmart.com

Source: walmart.com

300 Federal Tax Credits for Air Conditioners and Heat Pumps Does My New AC System Qualify. New Years Resolutions for your HVAC System. Tax credits for residential energy efficiency have now been extended retroactively through December 31 2021. If an advanced main air circulating fan that meets the definition of Qualified Energy Property in Section 25C of the IRC is installed in the homeowners principal. The only systems with tax.

Source: carrier.com

Source: carrier.com

To verify tax credit eligibility ask your hvac contractor to provide the manufacturer certification statement for. On top of that Indiana now. Post_title 118400 Description. The only systems with tax. This includes the cost of installation.

Source: payne.com

Source: payne.com

New Years Resolutions for your HVAC System. If you bought an air conditioner last year youre eligible for this tax break usually about 300 depending on the systems efficiency rating. No tax credits are currently offered on standard HVAC systems such as split systems or package systems. This tax credit allows 30 percent with a maximum limit of 1500 of an air. To verify tax credit eligibility ask your hvac contractor to provide the manufacturer certification statement for.

Source: bryant.com

Source: bryant.com

This includes the cost of installation. Installing a new central. On top of that Indiana now. Post_title 118400 Description. For example a tax-credit eligible split central air conditioner must have stated performance ratings of 13 EER and 16 SEER.

Source: amazon.com

Source: amazon.com

2015 Federal Tax Credits. On top of that Indiana now. If you are an eligible homeowner and a taxpayer you can claim 10 percent up to 500 of the total installation costs of your heating and cooling upgrades. Tax credits for residential energy efficiency have now been extended retroactively through December 31 2021. Installing a new central.

Source: lg.com

Source: lg.com

Under the new law for HVAC and hot water equipment the maximum a homeowner could claim is 300 for a qualified central air conditioner and heat pump and 150 for. Improvements made in 2014 will be. Cost about 9000 Lennox unit with 300 tax credit 1000 back from Costco plus 2 Jul 16 2014. Tax credits for residential energy efficiency have now been extended retroactively through December 31 2021. 300 Federal Tax Credits for Air Conditioners and Heat Pumps Does My New AC System Qualify.

Source: heil-hvac.com

Source: heil-hvac.com

If an advanced main air circulating fan that meets the definition of Qualified Energy Property in Section 25C of the IRC is installed in the homeowners principal. Air Conditioners Meeting the Following Requirements are Eligible for. If you are an eligible homeowner and a taxpayer you can claim 10 percent up to 500 of the total installation costs of your heating and cooling upgrades. Improvements made in 2014 will be. If you bought an air conditioner last year youre eligible for this tax break usually about 300 depending on the systems efficiency rating.

Source: daikincomfort.com

Source: daikincomfort.com

If you are an eligible homeowner and a taxpayer you can claim 10 percent up to 500 of the total installation costs of your heating and cooling upgrades. Air Conditioner Tax Credit 2015. 16 Seer Air Conditioner Tax Credit 2015. Post_title 118400 Description. Tax credits for residential energy efficiency have now been extended retroactively through December 31 2021.

Source: hvacdirect.com

Source: hvacdirect.com

The only systems with tax. Heating Ventilating Air Conditioning HVAC As much as half of the energy used in your home goes to heating and cooling. Under the new law for HVAC and hot water equipment the maximum a homeowner could claim is 300 for a qualified central air conditioner and heat pump and 150 for. 300 Federal Tax Credits for Air Conditioners and Heat Pumps Does My New AC System Qualify. Home improvements that fall under the Non-business Energy.

Source: kobiecomplete.com

Source: kobiecomplete.com

However if youve also installed a qualifying furnace at the same time. This includes the cost of installation. If you are an eligible homeowner and a taxpayer you can claim 10 percent up to 500 of the total installation costs of your heating and cooling upgrades. Improvements made in 2014 will be. If you bought an air conditioner last year youre eligible for this tax break usually about 300 depending on the systems efficiency rating.

Source: carrier.com

Source: carrier.com

Air Conditioner Tax Credit 2015. Under the new law for HVAC and hot water equipment the maximum a homeowner could claim is 300 for a qualified central air conditioner and heat pump and 150 for. Heating Ventilating Air Conditioning HVAC As much as half of the energy used in your home goes to heating and cooling. There has been alot of publicity about the Federal tax credits up to 1500 for high efficiency heating and air conditioning units. Cost about 9000 Lennox unit with 300 tax credit 1000 back from Costco plus 2 Jul 16 2014.

Source: lg.com

Source: lg.com

2015 Federal Tax Credits. Timing of upgrade dictates when the credit is received HVAC improvements made during 2015 will need to be claimed on. However if youve also installed a qualifying furnace at the same time. Air Conditioner Tax Credit 2015. Air Conditioners Meeting the Following Requirements are Eligible for.

Source: carrier.com

Source: carrier.com

Under the new law for HVAC and hot water equipment the maximum a homeowner could claim is 300 for a qualified central air conditioner and heat pump and 150 for. For example a tax-credit eligible split central air conditioner must have stated performance ratings of 13 EER and 16 SEER. Total cost to purchase an energy-efficient central air conditioning unit. New Years Resolutions for your HVAC System. The only systems with tax.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title new air conditioner tax credit 2015 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.