21++ New air conditioner tax credit 2019 information

Home » Wallpapers » 21++ New air conditioner tax credit 2019 informationYour New air conditioner tax credit 2019 images are ready. New air conditioner tax credit 2019 are a topic that is being searched for and liked by netizens now. You can Find and Download the New air conditioner tax credit 2019 files here. Find and Download all royalty-free photos and vectors.

If you’re looking for new air conditioner tax credit 2019 pictures information linked to the new air conditioner tax credit 2019 interest, you have pay a visit to the ideal blog. Our website frequently gives you hints for downloading the highest quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

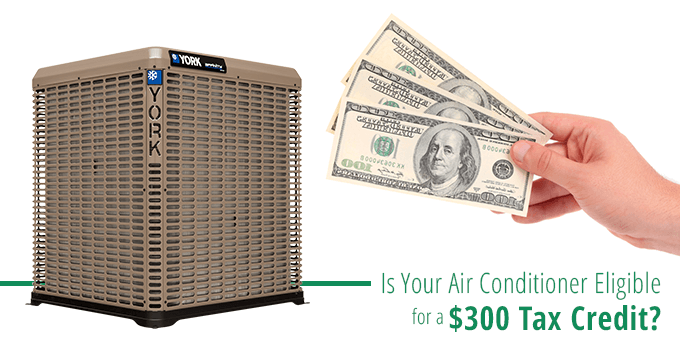

New Air Conditioner Tax Credit 2019. For full details see the Energy Star website. The IRS allows you to take the standard deduction. So making smart decisions about your homes heating ventilating and air conditioning HVAC system can have a big effect on your utility bills and your comfort. Qualified equipment includes solar hot water heaters solar electric equipment wind turbines and fuel cell property.

Hvac Upgrades That Qualify For Tax Credits Air Assurance From airassurance.com

Hvac Upgrades That Qualify For Tax Credits Air Assurance From airassurance.com

These HVAC federal tax credits for 2019 FAQs provide the pertinent information. The answer is no probably. SEER 16 EER 13 Package systems. The 30 percent credit also applies to systems placed in service during 2019. How much are the Federal tax credits for 2019. Accordingly does a new air conditioner qualify for tax credit.

SEER 16 EER 13 Package systems.

When you choose to claim a tax credit you do not have to itemize deductions. Heating Ventilating Air Conditioning HVAC As much as half of the energy used in your home goes to heating and cooling. 300 Requirements Split Systems. This is the last year for full tax credits at least until there is new legislation. Must Be Primary Residence You can only receive a tax credit for a new AC system when it is being installed in your primary residence. The answer is no probably.

Source: columbiapowerpartners.com

Source: columbiapowerpartners.com

However what we can say is. Tax Credit For New Furnace And Air Conditioner 2019A cooling efficiency of greater than or equal to 14 seer and. The nonbusiness energy property tax credit expired that would have allowed you to write off a new HVAC system. Now as of January 15 2021 the Tax Credit has been extended again. When you choose to claim a tax credit you do not have to itemize deductionsThe IRS allows you to take the standard deductionThe cost of a new central airconditioning system can run between 500-4000.

Source: pinterest.com

Source: pinterest.com

However what we can say is. If you had a tax liability of over 300 and purchased eligible equipment. It just makes sense to take advantage of the 300 maximum credit the IRS allows for energy-efficient AC units. A maximum tax credit of 500. Advanced Main Air Circulating Fan.

Source: walmart.com

Source: walmart.com

Accordingly does a new air conditioner qualify for tax credit. The answer is no probably. To verify tax credit eligibility ask your HVAC contractor to provide the Manufacturer Certification Statement for the equipment you plan to purchase. 26 for systems placed in service after 12312019 and before 01012021. SEER 16 EER 13 Package systems.

Source: lowes.com

Source: lowes.com

Federal Energy Credits for 2019. 300 Requirements Split Systems. Rest of the in-depth answer is here. Credits may even be higher for renewable energy like geothermal systems. These HVAC federal tax credits for 2019 FAQs provide the pertinent information.

Source: carrier.com

Source: carrier.com

This is the last year for full tax credits at least until there is new legislation. We recommend you leave the new AC unit installation to us and the tax preparation to your CPA. We are not experts in tax credits. The IRS allows you to take the standard deduction. The nonbusiness energy property tax credit expired that would have allowed you to write off a new HVAC system.

Source: bryant.com

Source: bryant.com

The 30 percent credit also applies to systems placed in service during 2019. What Is This Tax Credit Worth. For qualified HVAC improvements homeowners may be eligible to claim the federal tax credits equal to 10 of the installed costs. Tax Credit For New Furnace And Air Conditioner 2019A cooling efficiency of greater than or equal to 14 seer and. This means that certain qualifying air conditioners and heat pumps installed through December 31 2021 are eligible for a 300 tax credit.

Source: in.pinterest.com

Source: in.pinterest.com

This is the last year for full tax credits at least until there is new legislation. The answer is no probably. For qualified HVAC improvements homeowners may be eligible to claim the federal tax credits equal to 10 of the installed costs. How much are the Federal tax credits for 2019. For qualified HVAC improvements homeowners may be able to claim Internal Revenue Code Section 25C tax credits from 50 - 300 or in some cases 10 of the installed costs up to 500 maximum.

Source: airassurance.com

Source: airassurance.com

This includes the cost of installation. The nonbusiness energy property tax credit expired that would have allowed you to write off a new HVAC system. The IRS allows you to take the standard deduction. Heating Ventilating Air Conditioning HVAC As much as half of the energy used in your home goes to heating and cooling. If you install a new ac system in your primary residence that meets energy efficiency requirements the maximum amount of credit that you can receive back is 300.

Source: carrier.com

Source: carrier.com

While we can tell you what ACHeating units qualify for a tax credit we cant tell you if you qualify. Tax Credit For New Furnace And Air Conditioner 2019A cooling efficiency of greater than or equal to 14 seer and. In December 2019 Congress passed legislation that renewed the tax credits for 2020 and made them retroactive back to 2018. These HVAC federal tax credits for 2019 FAQs provide the pertinent information. However what we can say is.

Source: lowes.com

Source: lowes.com

For qualified HVAC improvements homeowners may be able to claim Internal Revenue Code Section 25C tax credits from 50 - 300 or in some cases 10 of the installed costs up to 500 maximum. In December 2019 Congress passed legislation that renewed the tax credits for 2020 and made them retroactive back to 2018. A maximum tax credit of 500. When you choose to claim a tax credit you do not have to itemize deductions. Tax Credit For New Furnace And Air Conditioner 2019A cooling efficiency of greater than or equal to 14 seer and.

Source: symbiontairconditioning.com

Source: symbiontairconditioning.com

The IRS allows you to take the standard deduction. Credits may even be higher for renewable energy like geothermal systems. Accordingly does a new air conditioner qualify for tax credit. Tax Credit For New Furnace And Air Conditioner 2019A cooling efficiency of greater than or equal to 14 seer and. This includes the cost of installation.

Source: kobiecomplete.com

Source: kobiecomplete.com

When you choose to claim a tax credit you do not have to itemize deductions. What Does it Mean for You and a Third Stimulus Check blog post. Rest of the in-depth answer is here. Credits may even be higher for renewable energy like geothermal systems. We recommend you leave the new AC unit installation to us and the tax preparation to your CPA.

Source: lowes.com

Source: lowes.com

The tax credit also retroactively applies to new air conditioners. If you purchased a system from Air Assurance in the past or are. Now as of January 15 2021 the Tax Credit has been extended again. The 30 percent credit also applies to systems placed in service during 2019. Accordingly does a new air conditioner qualify for tax credit.

Source: lg.com

Source: lg.com

What Does it Mean for You and a Third Stimulus Check blog post. If you purchased a system from Air Assurance in the past or are. When you choose to claim a tax credit you do not have to itemize deductions. To verify tax credit eligibility ask your HVAC contractor to provide the Manufacturer Certification Statement for the equipment you plan to purchase. Advanced Main Air Circulating Fan.

Source: homedepot.com

Source: homedepot.com

If you purchased a system from Air Assurance in the past or are. For qualified HVAC improvements homeowners may be eligible to claim the federal tax credits equal to 10 of the installed costs. How much are the Federal tax credits for 2019. Now as of January 15 2021 the Tax Credit has been extended again. Talk to your trusted HVAC contractor about installing a geothermal HVAC system this year to take advantage of the maximum savings.

Source: bryant.com

Source: bryant.com

30 for systems placed in service by 12312019. Rest of the in-depth answer is here. If you install a new AC system in your primary residence that meets energy efficiency requirements the maximum amount of credit that you can receive back is 300. What Is This Tax Credit Worth. For information on the third coronavirus relief package please visit our American Rescue Plan.

Source: trane.com

Source: trane.com

The 30 percent credit also applies to systems placed in service during 2019. However what we can say is. Credit amounts drop to 26 percent for. Must Be Primary Residence You can only receive a tax credit for a new AC system when it is being installed in your primary residence. What Does it Mean for You and a Third Stimulus Check blog post.

Source: pinterest.com

Source: pinterest.com

The answer is no probably. It just makes sense to take advantage of the 300 maximum credit the IRS allows for energy-efficient AC units. Federal Energy Credits for 2019. We are not experts in tax credits. For qualified HVAC improvements homeowners may be able to claim Internal Revenue Code Section 25C tax credits from 50 - 300 or in some cases 10 of the installed costs up to 500 maximum.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title new air conditioner tax credit 2019 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.